- Hunter's Insights

- Posts

- Amazon Just Crossed a Line — Competitors Appear on Your PDP

Amazon Just Crossed a Line — Competitors Appear on Your PDP

Welcome to our weekly newsletter, Hunter's Insights!

In this special edition, we bring you essential Amazon updates and industry insights to keep you ahead in the fast-paced world of e-commerce:

📈 Amazon Expands Sponsored Brands Product Collections With AI Curation

📊 Amazon Adds Section-Level Performance Insights to Brand Stores

⚡️ Amazon Confirms MCF Remains Compatible With TikTok Fulfillment

↩️ Amazon Tests a More Aggressive “Frequently Returned” Badge

🤖 Amazon Expands AI-Driven Shopping With Alexa as a Full Assistant

🆕 Amazon Adds a Consolidated View for Vine-Eligible Listings

🎙 Amazon DSP Integrates Podcast Audience Network

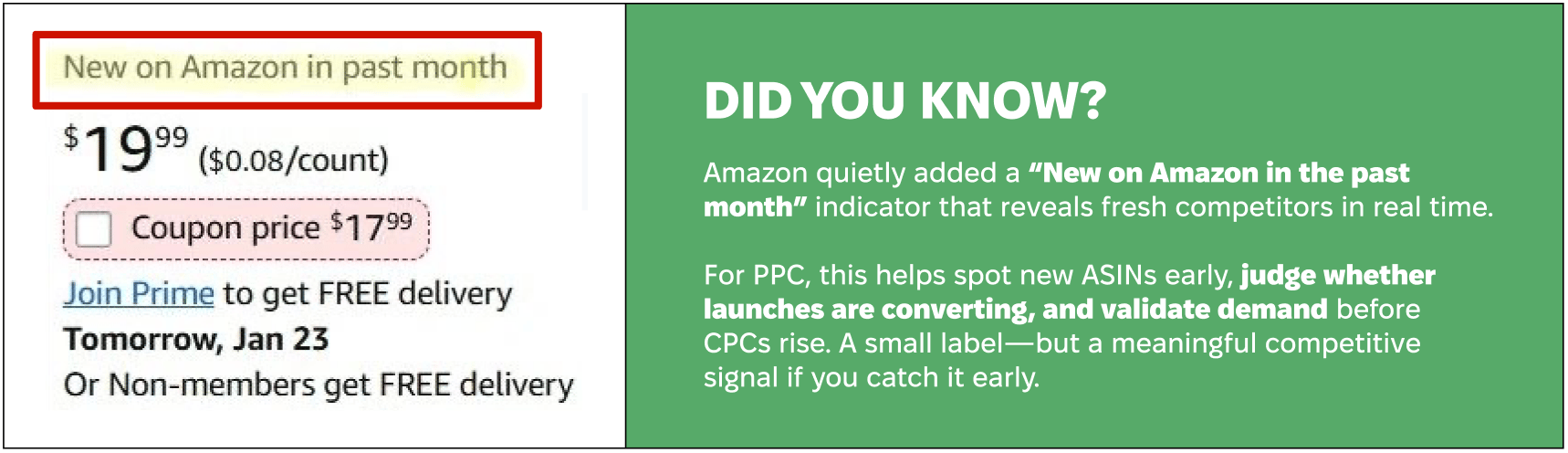

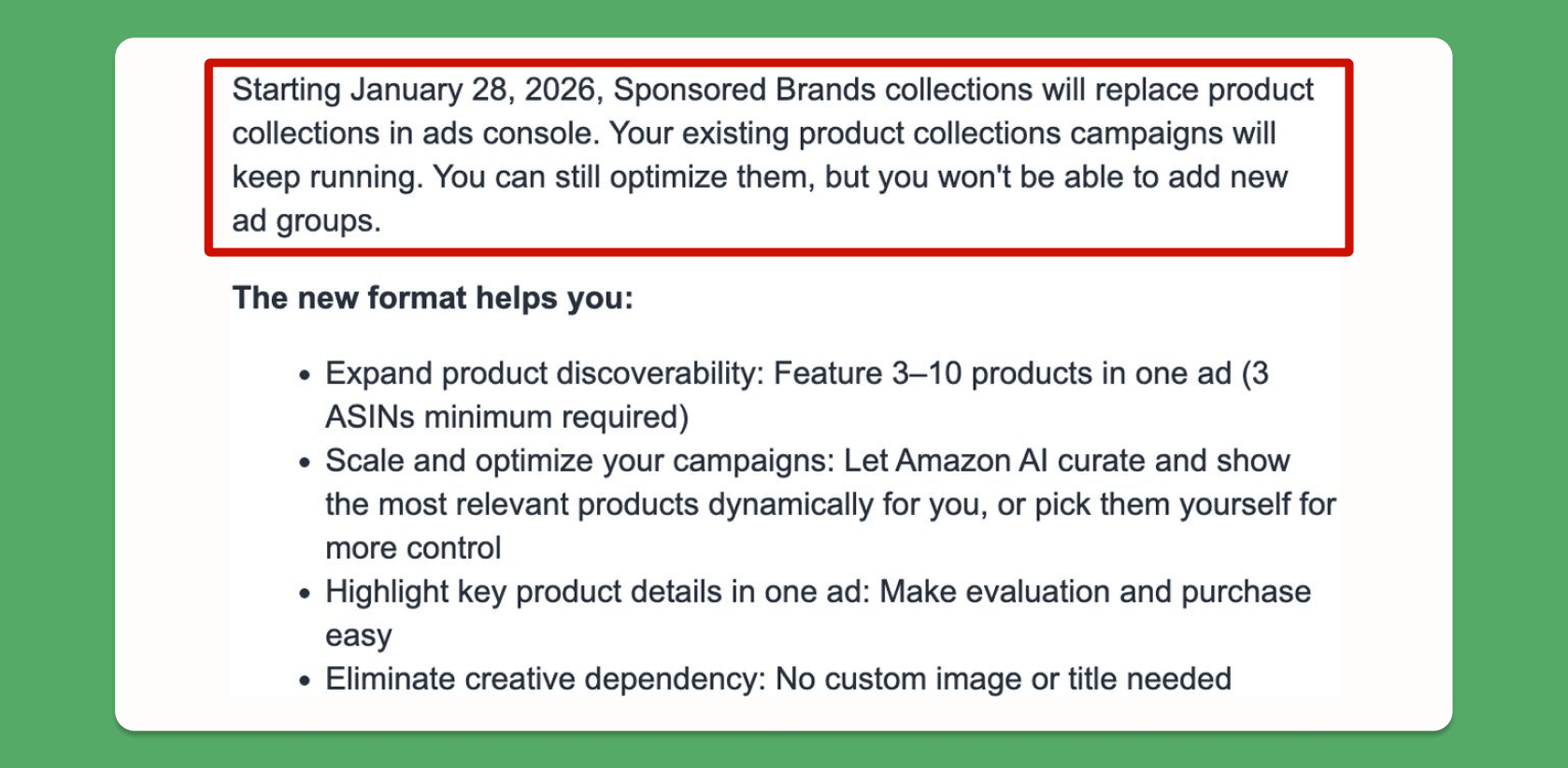

📈 Amazon Expands Sponsored Brands Product Collections With AI Curation

Amazon is updating its Sponsored Brands product collection ads to improve user experience through greater flexibility and automation. This simplifies ad creation, saving time for advertisers and enhancing customer engagement.

What’s new:

Larger product sets: Ads can now include 3–10 ASINs, up from three.

AI-driven selection: Amazon can dynamically curate relevant products, with manual selection options for advertisers.

Richer presentation: Key product details are highlighted in the ad for quicker evaluation.

No creative needed: Custom headlines and images are no longer required, simplifying setup.

Amazon is enhancing AI-powered personalization in ad delivery by utilizing real-time intent signals for product selection while still allowing manual advertiser options. This indicates a more dynamic role for AI in Sponsored Brands within Amazon Ads.

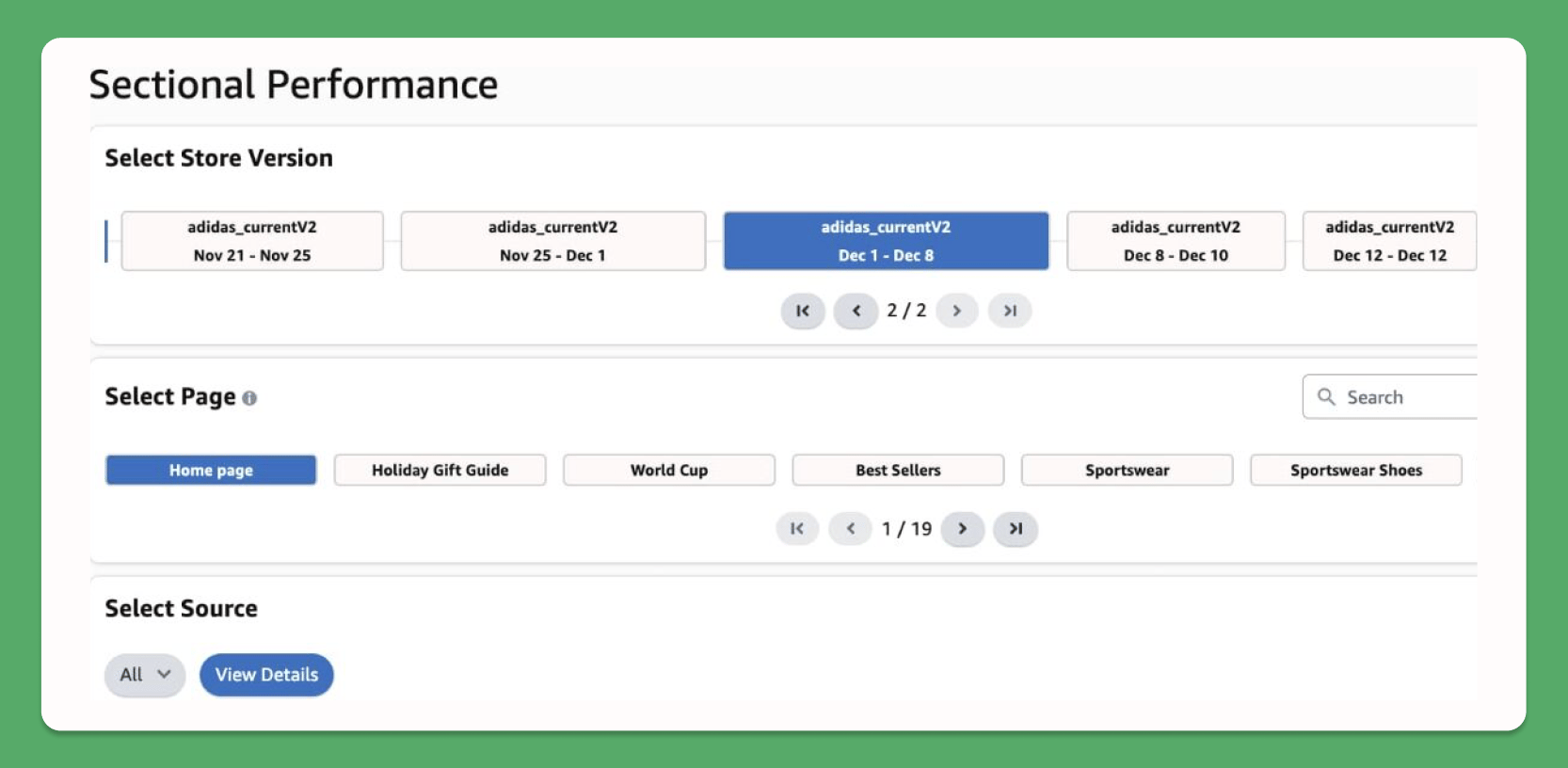

📊 Amazon Adds Section-Level Performance Insights to Brand Stores

Amazon has enhanced Brand Stores with section-level performance insights, providing sellers with data on impressions, clicks, and CTR for individual sections. This update helps brands understand engagement and optimize effectively.

What this update offers:

Clear attention signals: Identify which sections of your Brand Store receive impressions and clicks.

Actionable optimization: Enhance your layout and content based on click-through rates (CTR) rather than personal design preferences.

Better ROI on paid traffic: Optimize your Store's conversion rates for visitors you are already paying to attract.

This update transforms Brand Stores from a branding tool into a conversion tool, enabling brands to focus on performance effectiveness rather than just aesthetics.

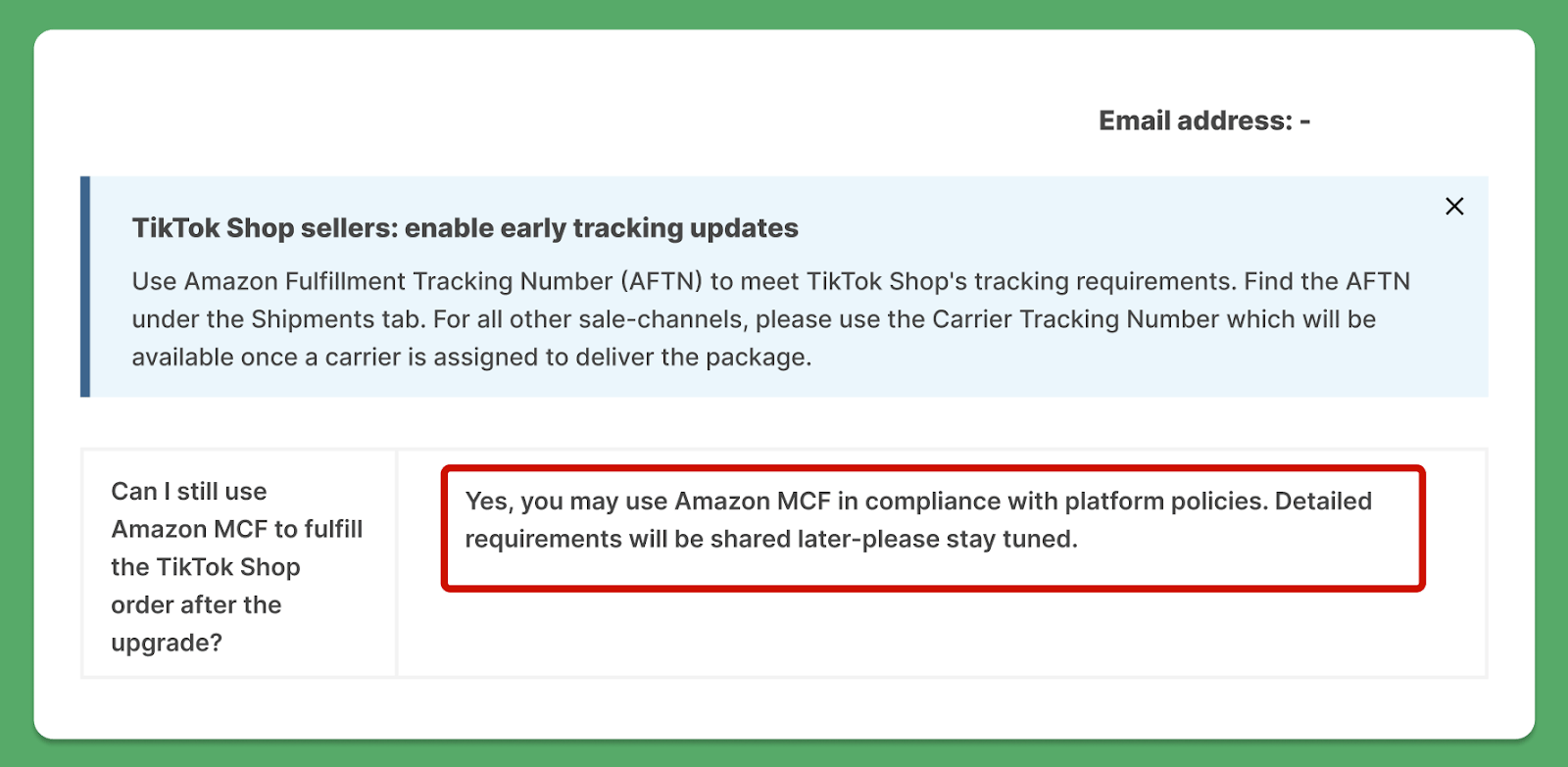

⚡️ Amazon Confirms MCF Remains Compatible With TikTok Fulfillment

TikTok's new shipping requirement raised concerns about Amazon Multi-Channel Fulfillment (MCF), but Amazon confirmed that MCF users will remain unaffected. They introduced a TikTok-specific USPS tracking number for order fulfillment, and TikTok clarified that its FBM shipping requirement does not apply to MCF.

What sellers need to know:

MCF is not impacted: TikTok’s FBM shipping requirement does not shut down MCF

USPS tracking solved: Amazon now provides TikTok-compatible USPS tracking for MCF orders

No workflow changes needed: Existing MCF setups remain valid

Integrations unaffected: Sellers using the MCF–TikTok integration do not need to take action

Despite recent speculation, MCF remains a supported and stable fulfillment option for TikTok sellers. For now, sellers using Amazon MCF—either directly or through integrations—can continue operating as usual without changes.

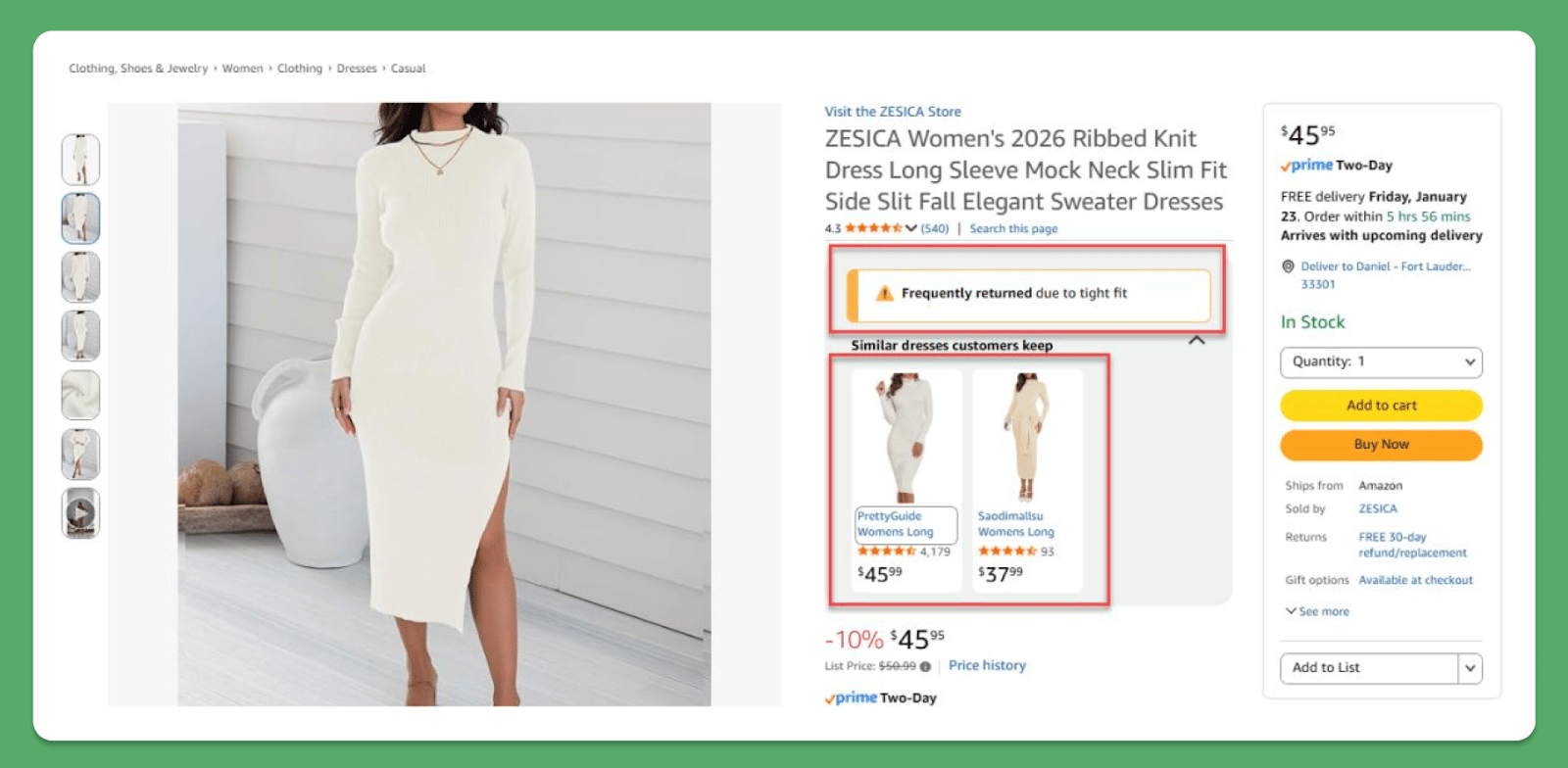

↩️ Amazon Tests a More Aggressive “Frequently Returned” Badge

Amazon is A/B testing a “Frequently Returned” badge that shows competitor products on the detail pages of high-return items. This aims to reduce returns and improve customer satisfaction, as returns are costly for the company.

Sellers can take steps if this badge appears on their listing:

Enhance Creatives: Include detailed sizing charts and real body types to better represent products.

Use Reviews: Highlight reviews that explain common return reasons like fit or material to set clear expectations.

Set Expectations: Provide clarity on potential return issues early in the buying process.

In categories like clothing, higher return rates are common due to the inability to try items on. Amazon's test suggests that informative listings are becoming more important than simply appealing ones that may lead to disappointment later.

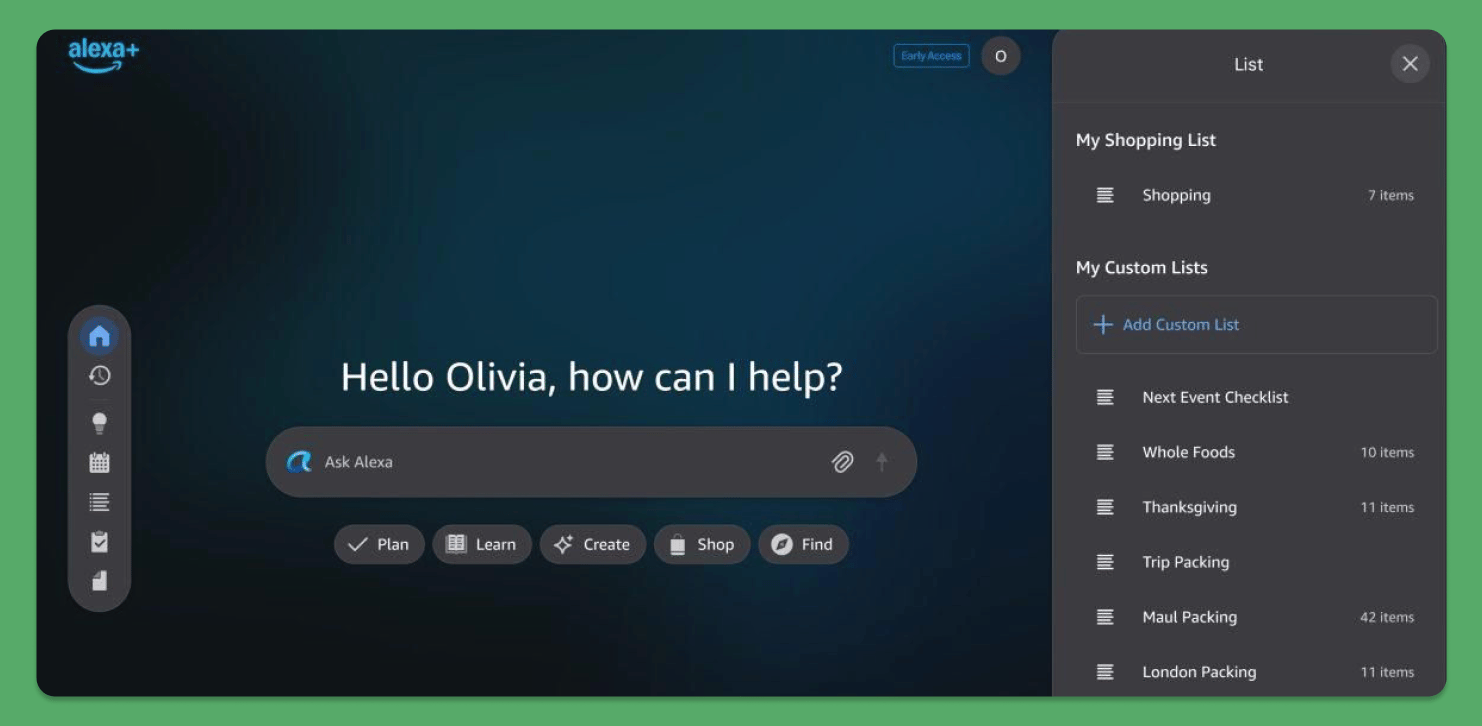

🤖 Amazon Expands AI-Driven Shopping With Alexa as a Full Assistant

Amazon has evolved Alexa into an AI shopping assistant that adapts to changing customer behaviors. Using tools like Rufus, it shifts from keyword searches to AI-guided exploration. Shoppers can now ask questions and compare options, allowing the AI to refine choices based on intent and context.

What sellers should be aware of:

Use-case clarity matters: Products must be positioned around how and when they are used, not just features

Structured data is critical: Attributes and clean catalog data directly influence AI relevance decisions

Listings must answer real questions: Plain-language explanations improve AI confidence in surfacing products

Catalog consistency counts: Vague, incomplete, or conflicting information makes products harder for AI to recommend

As Amazon integrates more AI into the buying process, product discovery will depend more on how effectively a product's role, use case, and value are communicated, rather than solely on keyword ranking. For sellers, this means clarity and structure are now as essential as traffic and bids for product visibility.

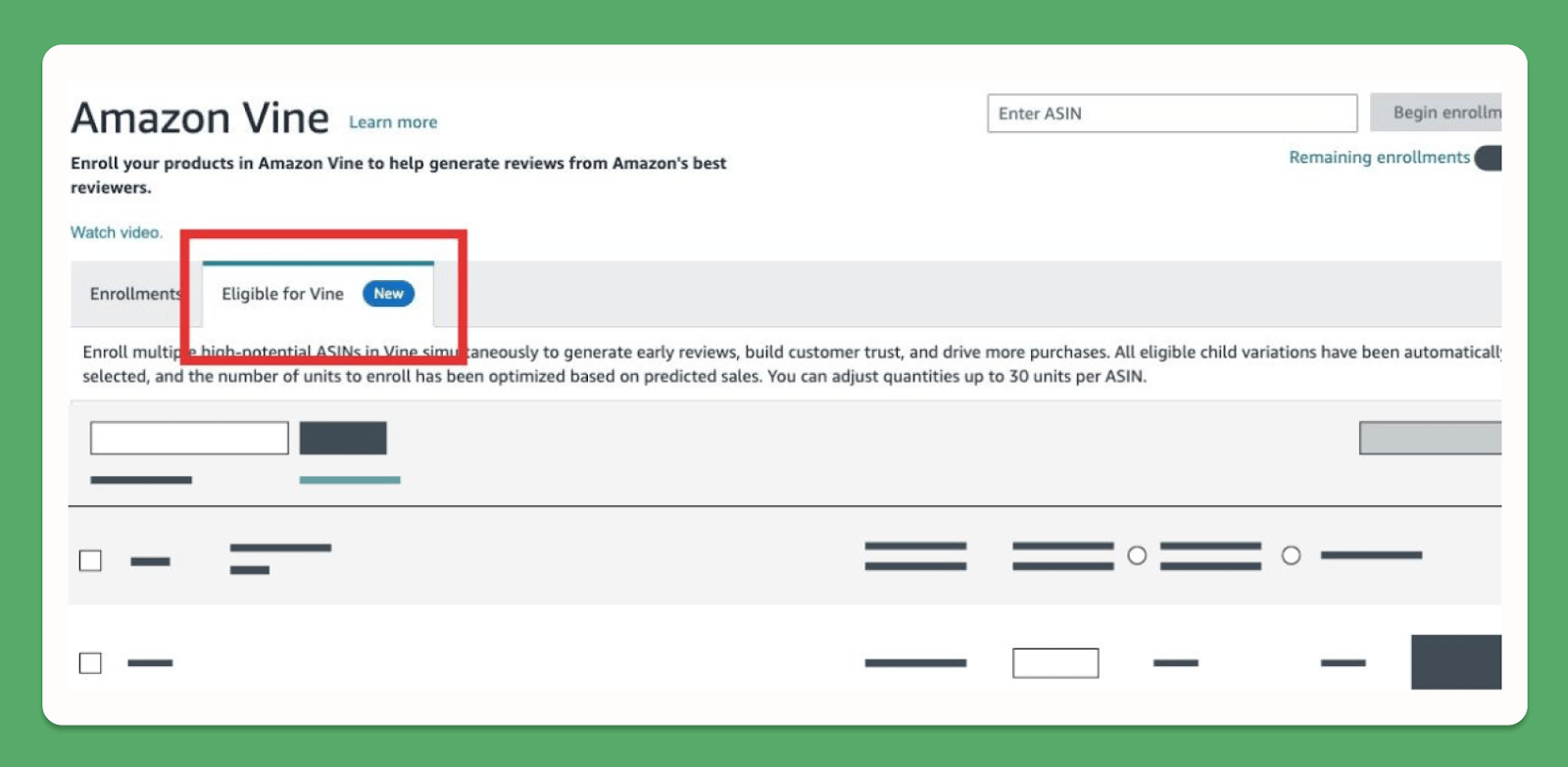

🆕 Amazon Adds a Consolidated View for Vine-Eligible Listings

Amazon has introduced a new tab in Seller Central that shows all Vine-eligible ASINs, making manual checks unnecessary. Eligibility rules, such as review count and FBA status, remain the same, allowing sellers to quickly identify qualifying ASINs without tracking systems.

Why this matters:

Operational friction removed: No more manual auditing across dozens or hundreds of ASINs

Higher Vine adoption likely: Amazon eliminated the real bottleneck—eligibility discovery

Faster review velocity: Easier enrollment supports quicker momentum on new or refreshed listings

This update doesn’t change Vine limits or fees, but suggests Amazon aims to boost review generation by simplifying compliance and enrollment. By easing participation for sellers, Amazon hopes to attract more brands, resulting in more and better product reviews.

🎙 Amazon DSP Integrates Podcast Audience Network

Amazon has integrated its Podcast Audience Network into Amazon DSP, allowing advertisers to manage podcast campaigns alongside other digital media. This integration combines Amazon’s first-party data with ART19 audience intelligence for precise targeting, streamlining the podcast advertising process.

Key benefits for advertisers:

Unified campaign management: Run podcast, display, video, and streaming TV campaigns within Amazon DSP

Enhanced targeting precision: Leverage Amazon first-party signals combined with ART19 audience insights

Consistent measurement: Apply the same attribution and reporting framework across podcast and digital media

Premium inventory access: Reach engaged audiences through curated, high-quality podcast content

Amazon has integrated podcast advertising into its DSP for self-service access in the U.S., targeting agencies, direct advertisers, and holding companies. This positions audio as a key component of its omnichannel advertising strategy, simplifying the planning, measurement, and scaling of audio alongside digital media.

Crushing it with $20K+ monthly sales on Amazon?

Let’s help you break through to the next level – guaranteed! 🚀

Our team of Amazon growth experts specializes in scaling successful businesses like yours. We’ll perform a deep dive audit of your operations, from optimizing product listings to fine-tuning your ad campaigns.

Here’s what we offer:

Comprehensive Analysis: Pinpoint the bottlenecks holding back your growth.

Actionable Recommendations: Uncover high-impact opportunities to boost sales.

Proven Results: We don’t just advise – we deliver guaranteed results.

👉 Ready to scale?

Click below to claim your free audit and unlock your business’s potential!

How did you like today's Newsletter? |

Reply