- Hunter's Insights

- Posts

- Amazon Just Changed Ads – Your Sponsored Products Now Live Inside AI Conversations

Amazon Just Changed Ads – Your Sponsored Products Now Live Inside AI Conversations

Welcome to our weekly newsletter, Hunter's Insights!

In this special edition, we bring you essential Amazon updates and industry insights to keep you ahead in the fast-paced world of e-commerce:

🤖 Amazon Is Placing Sponsored Products Inside Rufus Conversations

🚫 Amazon Flat File Templates Will Stop Working at the End of February

🔎 Search Query Performance Is Now Live in Vendor Central

💲 Amazon’s SP-API Pricing Change Will Reshape Seller Software Costs

‼️ Amazon Updates OTDR Enforcement for Seller-Fulfilled Listings

🚩 New Amazon Ads Feature Automatically Flags Winning Keywords

💬 Amazon Enhances AI Explanations in Account Health

🤖 Amazon Is Placing Sponsored Products Inside Rufus Conversations

Amazon has launched Sponsored Products Prompts, integrating ads directly into conversations with Rufus AI. Instead of traditional banners, ads now appear as part of AI-generated responses. For instance, if a user asks about plant-based dish soap, a Sponsored Product may be included in the reply.

Key points include:

AI-generated prompts: Questions are created automatically from your product data and campaigns.

Auto-enrollment: Campaigns are automatically included during the beta phase.

Conversational placement: Ads are integrated into AI answers rather than appearing in standard ad slots.

Free during beta: Early results show significant impressions and conversions with no ad spend.

From January 5 to February 14, 2026, the SP Prompts Report recorded 35 prompts from 18 AI-generated questions, generating about 5,000 impressions, 41 clicks, and 4 orders worth $512.71 at no cost. Advertisers should assess these prompts for messaging alignment. Prompts can be toggled on or off, and optimization could provide an edge if the feature shifts to a paid auction model.

🚫 Amazon Flat File Templates Will Stop Working at the End of February

Amazon’s updated flat file templates went live in late 2024, but many sellers continued using older versions without errors. This grace period ends this month; after February 2026, outdated templates will no longer upload. The update involves standardizing product data structure across categories, including required attributes and variation themes.

What’s changing:

Old templates will fail: The dual-system acceptance window closes at the end of February 2026

New required attributes: Some previously optional fields are now mandatory, increasing suppression risk

Deprecated variation themes: Families using “Deprecated: Do Not Use” themes must be rebuilt

B2B offer restructuring: “Business Price” is now grouped differently under the updated Offer (Amazon Business) structure

Sellers who delay may experience upload rejections and listing suppression. It's crucial to download the latest category template to identify new attributes and audit pricing feeds. Migrating while both systems accept uploads provides time to fix errors; after the cutoff, troubleshooting will be limited to active listings.

🔎 Search Query Performance Is Now Live in Vendor Central

Amazon has introduced Search Query Performance (SQP) within Vendor Central, enhancing search analytics tools for Vendors. This change brings first-party search visibility in line with Seller accounts, allowing better alignment between retail and advertising strategies.

Key benefits for Vendors include:

Deeper search term insights for shopper behavior

Alignment of organic and paid strategies

Improved tracking of brand search effectiveness

Data-driven identification of growth opportunities

For Vendor teams, this closes a long-standing gap between search behavior and investment strategy. Brands that understand search intent—not just sales volume—are better positioned to win digital shelf space and allocate spend more efficiently.

💲 Amazon’s SP-API Pricing Change Will Reshape Seller Software Costs

Amazon has introduced new SP-API pricing, including a $1,400 annual fee plus usage-based charges based on API volume. This will impact tools used by sellers, as many third-party software relies on API calls. The fees particularly affect high volumes of GET requests, increasing costs for developers.

What this means for sellers:

Usage-based pressure: Higher API call volumes push developers into paid tiers

Likely cost pass-through: Many SaaS providers will adjust pricing to protect margins

Stack inefficiency exposed: Redundant or overly frequent data pulls increase structural cost

Software inflation risk: Tools that cost $50/month today may cost significantly more in 2026

Developers can either absorb costs, optimize infrastructure, or raise prices for customers as API access shifts to a variable cost. Those with complex tech stacks should reassess their tools and data pulls, focusing on intentional management that prioritizes efficiency and revenue.

‼️ Amazon Updates OTDR Enforcement for Seller-Fulfilled Listings

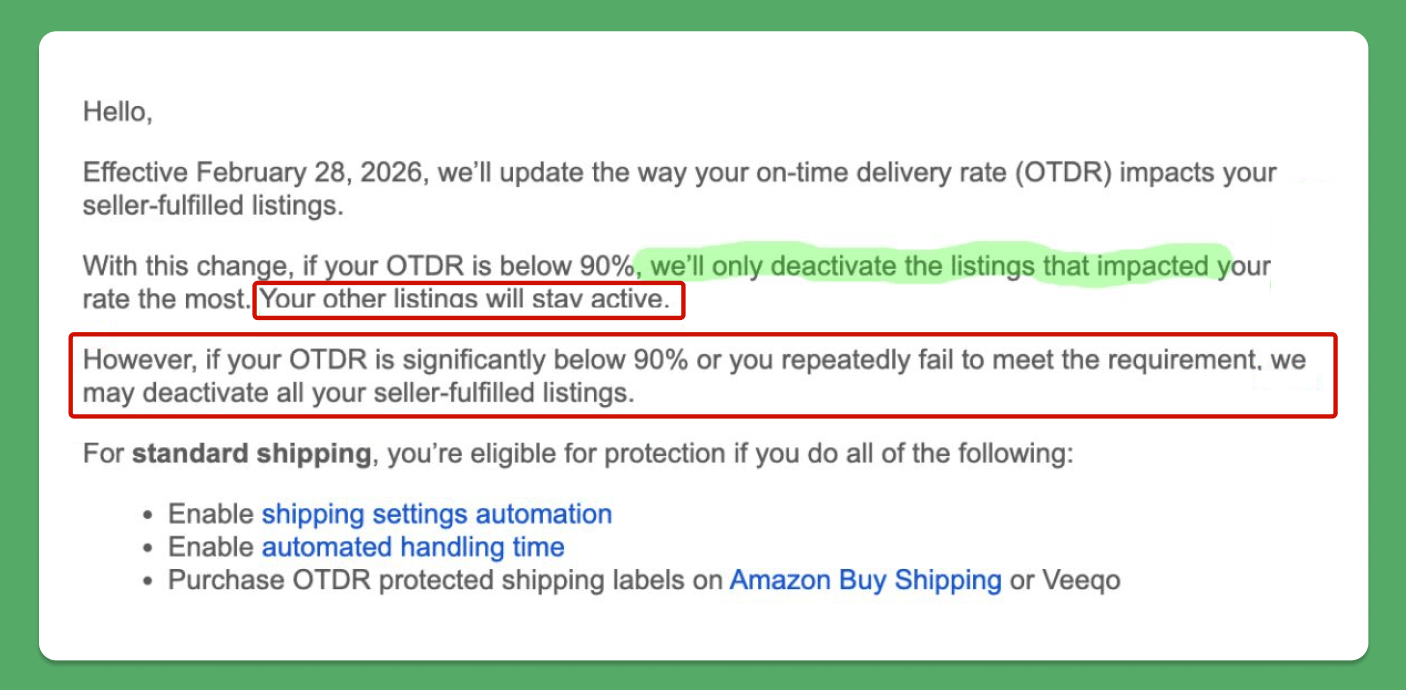

Amazon will update the On-Time Delivery Rate (OTDR) for seller-fulfilled listings on February 28, 2026. The performance threshold remains at 90 percent, but enforcement will focus on specific listings that lower OTDR, rather than the entire seller catalog.

What’s changing:

Threshold unchanged: 90 percent OTDR still required

Targeted enforcement: Only listings hurting performance are deactivated first

Full deactivation still possible: Sellers significantly below 90 percent or repeatedly missing targets may still see all seller-fulfilled listings removed

To improve standard shipping protection and reduce risk, sellers should automate shipping settings, set handling times, and buy OTDR-protected labels via Amazon Buy Shipping. This update enhances SKU-level enforcement and supports consistent delivery performance.

🚩 New Amazon Ads Feature Automatically Flags Winning Keywords

Amazon has launched a new feature in Sponsored Products Auto Campaigns that suggests high-performing search terms and ASINs based on your campaign data. This update aims to minimize manual analysis by showcasing effective keywords and product targets for easy integration into manual campaigns.

Key features include:

Automated performance scan: Amazon identifies strong search terms and ASINs from Auto Campaign data.

One-click transfer: Add suggested terms directly to manual campaigns or ad groups.

Scale winning queries: Move high performers into various targeting campaigns.

Built-in shortcut: Reduces manual filtering of large search term reports.

This feature can save optimization time for advertisers managing multiple campaigns, highlighting potential opportunities without sifting through extensive data. Remember to validate suggestions against your ACOS and profitability targets before scaling.

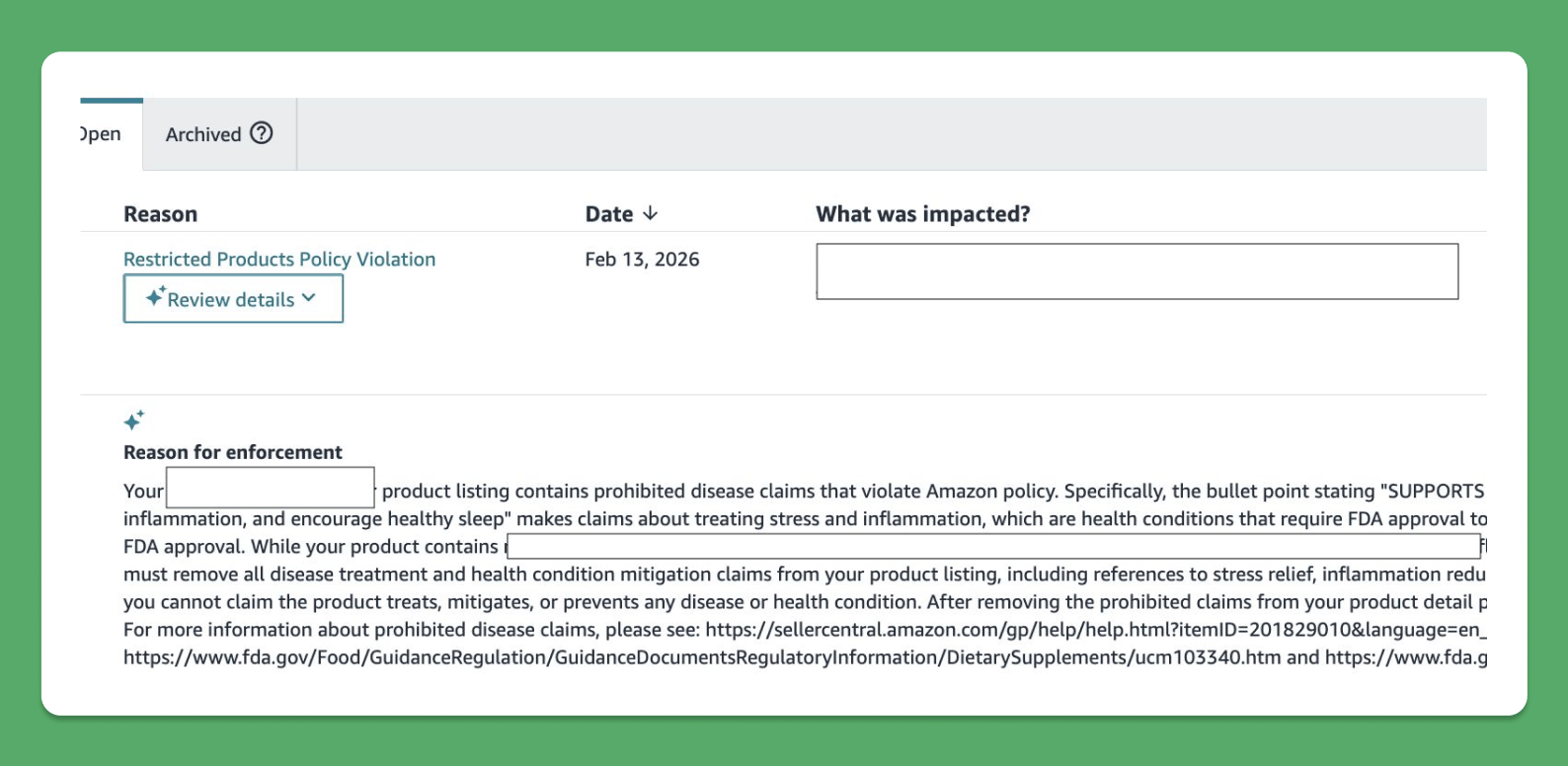

💬 Amazon Enhances AI Explanations in Account Health

Amazon has improved the Seller Central Account Health feature by providing clearer, AI-generated guidance for policy violations and appeals.

This update includes:

Detailed violation breakdowns: Clearer reasons for flagged listings or accounts.

Specific appeal guidance: Instructions on required documentation.

Rejection feedback clarity: Outlines what’s missing if an appeal is denied.

Accessible view: Available under the “Review Details” dropdown for each violation.

These enhancements streamline the appeal process, reduce guesswork, and improve resolution efficiency for sellers. While still complex, this update marks progress toward a more transparent support experience.

Crushing it with $20K+ monthly sales on Amazon?

Let’s help you break through to the next level – guaranteed! 🚀

Our team of Amazon growth experts specializes in scaling successful businesses like yours. We’ll perform a deep dive audit of your operations, from optimizing product listings to fine-tuning your ad campaigns.

Here’s what we offer:

Comprehensive Analysis: Pinpoint the bottlenecks holding back your growth.

Actionable Recommendations: Uncover high-impact opportunities to boost sales.

Proven Results: We don’t just advise – we deliver guaranteed results.

👉 Ready to scale?

Click below to claim your free audit and unlock your business’s potential!

How did you like today's Newsletter? |

Reply